Aster Group invested a record £106.2million in maintenance and repairs to its homes in the year to March 2024, according to its latest financial statement.

The housing association, which has over 37,000 properties across the south of England and London, posted a turnover of £313.7million (2023: £301million) and an operating profit of £73.7million (2023: £66.8million). Pre-tax profit was down year-on-year to £41.1million (2023: £55.3million) following a continued and all-time-high investment in its homes, as well as cost increases caused by inflation. Pre-tax profit in the previous year was also inflated by a one-off £12.8million gain following the Group’s acquisition of Enham Trust.

During the financial year, Aster saw its costs associated with managing social housing properties and services increase by £19.1million across the Group. Aster completed over 132,000 (2023: 120,000) repairs over the period and increased investment in major home improvements by £8.7million, coupled with an additional £12.3million increase in spend on capitalised works.

Aster delivered close to 1,000 homes over the course of the financial year, which also saw it announce plans for its largest-ever investment in development – £585m by March 2026 – and pledging to build around 2,300 new homes over the same period. It also issued its second £250million sustainability bond in 2023, funding that fuels investment in environmental and social benefits to both new and existing housing.

Aster announces largest annual investment in new homes

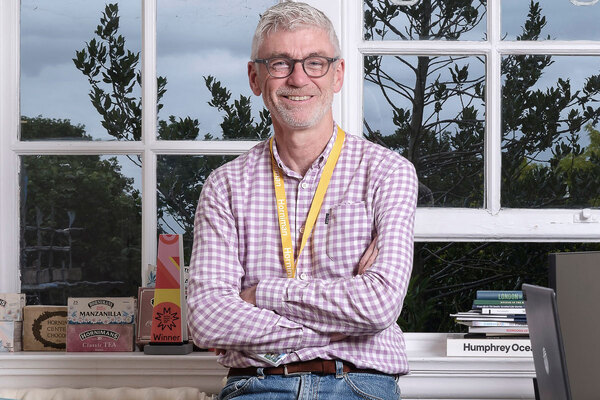

Bjorn Howard, group CEO at Aster Group, said: “It’s been an incredibly challenging year for the social housing sector. Despite a real-term decrease in rental income due to inflation, a robust balance sheet has meant that this year we spent a record amount on our repairs and maintenance. This along with the significant investment we have made in our customer services modernisation programme, shapes how we deliver the best possible homes, services and experiences for our customers.”

“While investing in our homes has quite rightly been our focus this year, we’ve also continued to play our part in tackling the housing shortage by providing some 3,000 people with a safe, secure place to call home.”

Aster’s development strategy deploys a diverse range of delivery methods including Section 106, its own land-led scheme and a £127.5million strategic partnership with Homes England. Aster confirmed its latest joint venture with West Sussex-based developer, Thakeham, earlier in 2024, a partnership that will deliver 120 net zero carbon homes in the county.

The Group is also one of the most active housing association providers of Community Land Trust partnerships in the UK, having completed 13 schemes to date. The Group is set to start building a further 100 CLT homes in the next 12 months.

Its record investment in new homes over the next two years is part of a larger, £1.9billion programme to build 8,500 homes over the next seven years.

Bjorn Howard added: “The need for new affordable homes is only going to increase, with the cost-of-living still high and a new government that has put housebuilding at the forefront of its strategy for economic growth. A strong balance sheet means we are well-placed to deliver the affordable homes needed across our regions.”

“We’ve set out an ambitious programme centred around our commitment to invest in our customers’ homes and our service offer and achieving record numbers of homes. The scale of the challenge for the housing sector ahead is significant but we look forward to rising to it.”